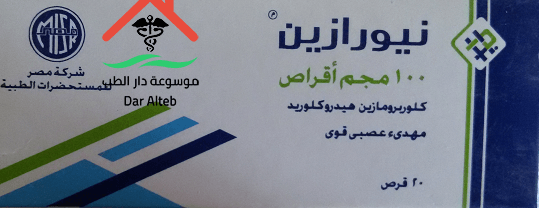

نورازين هو أحد الأدوية المتخصصة في علاج القيء والغثيان، وغالباً ما يستخدم كمسكن قوي لجميع الآلام التي يشعر بها الإنسان، بالإضافة إلى العديد من الاستخدامات الأخرى للدواء والتي سنتعرف عليها بالتفصيل من خلال المقالة. وسنتعرف أيضًا على الجرعة المسموح بها من هذا الدواء وآثاره الجانبية.

مؤشرات لاستخدام الدواء نورازين نورازين

محتوي المقالة

- يستخدم هذا الدواء لعلاج العديد من الحالات، منها:

- يساعد على علاج مشكلة القيء التي يعاني منها الكثير من الأشخاص نتيجة التسمم.

- يعمل كمسكن قوي لأي ألم يشعر به الإنسان، وخاصة الألم الناتج عن التوتر العصبي.

- يعالج جميع الالتهابات المعوية الخطيرة.

- يستخدم كعلاج قوي وفعال لحكة الجلد التي تحدث نتيجة التعرض المستمر لأشعة الشمس الضارة.

الجرعة المحددة من نورازين نورازين

- الجرعة المناسبة من دواء القيء هي 25 إلى 50 ملغ يوميا.

- أما الجرعة المحددة من الدواء لعلاج الأمراض العصبية فهي تتراوح بين 76 و500 ملغم مرة واحدة فقط يومياً.

- الجرعة المناسبة للأطفال أقل من 5 سنوات هي 1 إلى 2 ملغ مرة واحدة يومياً.

- الجرعة الموصى بها للأطفال فوق سن 5 سنوات هي نصف جرعة البالغين.

الآثار الجانبية للنورازين نورازين

يسبب هذا الدواء بعض المضاعفات والآثار الجانبية، وهي:

- المعاناة من القلق والتوتر الشديدين.

- الإصابة بمرض باركنسون.

- اضطرابات واضطرابات كبيرة في حركة الإنسان.

- اضطرابات كثيرة في تنظيم حركة الدم في جسم الإنسان.

- ارتفاع ضغط الدم الشرياني الشديد عند البشر.

- الإصابة بالكثير من النوبات

- التعرض للغباء واللامبالاة.

- الشعور بالصداع المستمر.

- الدوخة والغثيان.

- خلل في عمل الجهاز الهضمي عند الإنسان.

- يزيد من عدد دقات قلب الإنسان.

- مشاكل واختلالات هرمونية كبيرة.

- العديد من الاضطرابات في خلايا الدم البشرية.

موانع استخدام دواء نيورازين نورازين

- يمنع استعمال الدواء في حالة الإغماء.

- يجب تجنبه من قبل الأشخاص الذين يعانون من حساسية تجاه مكونات هذا الدواء.

سعر دواء نورازين نورازين

سعر نيورازينا في الأسواق المصرية والصيدليات 2.50 جنيه مصري فقط.

نشرت أصلا على 29 أغسطس 2019 الساعة 10:09 صباحًا