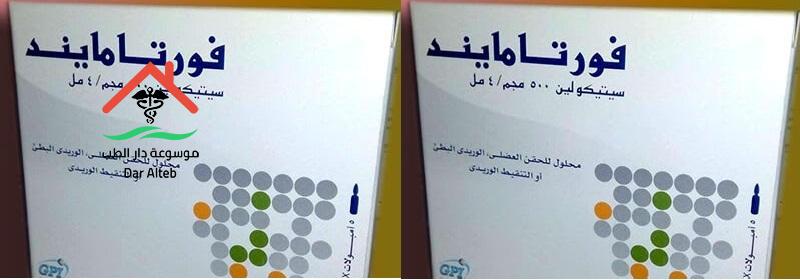

جرعة فورتاميند ومؤشرات للاستخدام. يعتبر فورتاميند دواء لعلاج إصابات الأوعية الدموية الدماغية. المادة الفعالة للدواء هي سيتيكولين (ملح الصوديوم). الدواء متوفر على شكل محلول للحقن العضلي والوريدي أيضًا. تعرف على أهم استخداماته من خلال هذا المقال وجرعته المحددة وكذلك الآثار الجانبية التي تنتج عن تناوله دون استشارة الطبيب المختص أو الصيدلي.

مؤشرات لاستخدام فورتاميند

محتوي المقالة

للدواء العديد من الاستخدامات، ومن أهم هذه الاستخدامات ما يلي:

- يستخدم الدواء لعلاج جميع إصابات الأوعية الدموية الدماغية، سواء كانت حادة أو تحت الحادة.

- يعالج جميع الكدمات التي تصيب منطقة الرأس والمضاعفات الكثيرة التي تنتج عنها.

- يستخدم في علاج مرض الزهايمر.

- يعالج جميع الإصابات الخطيرة التي تحدث في منطقة الدماغ.

- يستخدم في علاج مرض باركنسون.

- يستخدم في علاج حالات النسيان الشديدة عند كبار السن.

- يستخدم في بعض الحالات لعلاج تأخر النطق والكلام عند الأطفال الصغار، وكذلك فرط النشاط وضعف التركيز عند هؤلاء الأطفال.

اقرأ أيضا

الوقاية من السكتة الدماغية وأعراضها

الجرعة وطريقة استخدام فورتاميند

- الجرعة المحددة من الدواء هي أمبولات 500 ملغ، مرة إلى أربع مرات يوميا لمدة تصل إلى ستة أسابيع، حسب طبيعة الحالة الطبية لكل شخص.

- الجرعة المحددة من الدواء في حالة الأطفال هي 5 مل مرة واحدة فقط في اليوم.

موانع استخدام فورتاميند

- يمنع تناول واستخدام هذا الدواء في الحالات التالية:

- هو بطلان إذا كان هناك زيادة في التوتر العصبي الودي.

- كما يمنع استخدامه في حالة الحساسية الشديدة لأي من مكونات الدواء وخاصة للمادة الفعالة للدواء وهي سيتيكولين.

- ويجب ألا تزيد جرعة الدواء عن 1000 ملغ يومياً في حالة حدوث نزيف حاد داخل جمجمة الإنسان.

- يجب على النساء الحوامل والمرضعات التوقف عن استخدام الدواء.

اقرأ أيضا

Cerebroforte: مؤشرات للاستخدام والجرعة المسموح بها

الآثار الجانبية للفورتاميند

قد يؤدي تناول الدواء إلى حدوث بعض الآثار الجانبية التالية:

- انخفاض حاد في ضغط الدم لدى بعض الأشخاص.

- ألم ملحوظ في منطقة المعدة، ويصاحب هذا الألم شعور بالغثيان والقيء.

- العصبية المفرطة.

- الدوخة الشديدة

- احمرار في منطقة العين وفي جميع أنحاء الوجه.

سعر فورتاميند

- سعر قطرات Fortamind هو 40 جنيهًا إسترلينيًا

- سعر أمبولة فورتاميند هو 52.50 جنيه إسترليني

نشرت أصلا على 25 أغسطس 2019 الساعة 7:37 مساءً