- كاس العالم للاندية 2025 امريكا حقوق البت والقنوات ناقلة

- تردد قناة إم بي سي الرياضية mbc sport الجديد نايل سات

- أفضل 5 فرص عمل في المغرب لعام 2024: ابدأ عملك الخاص واكسب 10000 درهم شهريًا

- حقوق بت باقة CANAL + تردد الفرنسية Contact من الموسم القادم الى غاية 2027

- شرح بسيط ..خطوات التسجيل في سكنات عدل 3 2024 بالجزائر

الدول العربية

تعرف علي مقياس موهبة للقدرات المتعددة 2024

مقياس موهبة للقدرات المتعددة هو تطبيق أنشأته هيئة التقويم التربوي بالتعاون مع…

تعرف علي قوات درع الجزيرة المشتركة – … 2024

لقد برع الله تعالى في خلق الكون والطبيعة وفق قوانين علمية دقيقة…

تعرف علي شروط التقديم الحرس الوطني بكلية الملك خالد العسكرية لحملة الثانوية 2024 – … 2024

متطلبات التقديم للحرس الوطني في كلية الملك خالد العسكرية لحملة الثانوية العامة…

تعرف علي نظام الطلاق الجديد 2024 في السعودية – … 2024

نظام الطلاق الجديد 2024 في السعودية هو أحد نتائج تطور النظام التشريعي…

تعرف علي متجر جوي joy السعودية 2024

“المصممات السعوديات، نصنع التاريخ بشغفنا بالتصميم.” بهذه الجملة تم تقديم المجموعة. من…

تعرف علي موعد الدوام الشتوي لعام 2024 – … 2024

الجدول الشتوي لعام 2024؛ لا بد أن لديكم بعض الأسئلة حول الجدول…

تعرف علي تجديد الإقامة ربع سنوي في نظام الإقامة الجديد – … 2024

تجديد الإقامة يتم بشكل ربع سنوي. من أهم قرارات الحكومة السعودية والتي…

تعرف علي أفضل 5 محلات بيع الشموع بالجمله في الرياض – … 2024

محلات بيع الشموع بالجملة في الرياض. وفي أيامنا هذه نجد أن الشموع…

تعرف علي معنى رمه بالسعودي – … 2024

معنى الرامة في السعوديةفي مواجهة الغزو الفكري الأوروبي المتزايد للدول العربية، أصبح…

أخبار رياضة

كاس العالم للاندية 2025 امريكا حقوق البت والقنوات ناقلة

كأس العالم للأندية 2025 في أمريكا لكرة القدم التي ستنطلق من 15…

تردد قناة إم بي سي الرياضية mbc sport الجديد نايل سات

أعلنت شركة إم بي سي غروب ، عن اطلاق قناة أم بي…

أفضل 5 فرص عمل في المغرب لعام 2024: ابدأ عملك الخاص واكسب 10000 درهم شهريًا

إذا كنت مغربي وتبحث عن فكرة مشروع مربح في المغرب يحقق لك…

حقوق بت باقة CANAL + تردد الفرنسية Contact من الموسم القادم الى غاية 2027

حقوق بت قنوات كنال بليس و التردد canal plus 2025 2026 علي…

طريقة انشاء مدونة الكترونية مربحة وردبريس و بلوغر .. افضل نيتش 2024

كيفية اختيار فكرة مدونة إلكترونية (تحديد النيش) تُعد أمرًا ضروريًا لكل من…

أتقن تحسين محركات البحث لوردبرس: خطوات عملية لتصدر نتائج البحث في عام 2024

يعد تحسين محركات البحث (SEO) أحد أهم فروع التسويق الإلكتروني لأنه يستطيع…

دليل شامل لأفضل 39 مشروعًا مربحًا لعام 2024: حقق حلمك في تحقيق 1000 دولار شهريًا

في عالم الأعمال وريادة الأعمال، تعد المشاريع المربحة من أهم المحاور التي…

تعرف على أفضل 14 موقع لكسب المال عن طريق الكتابة 2024

تعد الكتابة إحدى الوسائل الفعالة للتعبير عن الأفكار ونقل المعرفة، وفي ظل…

تعرف على أهم 5 مشاريع صغيرة لربح ما لا يقل عن 900$ شهريا 2024

هل أنت شاب تبحث عن مشاريع صغيرة وتريد تغيير حياتك المالية نحو…

الإقتصاد

-

تردد القنوات

كاس العالم للاندية 2025 امريكا حقوق البت والقنوات ناقلة

كأس العالم للأندية 2025 في أمريكا لكرة القدم التي ستنطلق من 15 يونيو إلى 13 يوليو 2025 ، ولتي ستعرف…

أكمل القراءة » -

تردد القنوات

تردد قناة إم بي سي الرياضية mbc sport الجديد نايل سات

أعلنت شركة إم بي سي غروب ، عن اطلاق قناة أم بي سي الرياضية mbc sport علي القمر نايل سات…

أكمل القراءة » -

تقنية

أفضل 5 فرص عمل في المغرب لعام 2024: ابدأ عملك الخاص واكسب 10000 درهم شهريًا

إذا كنت مغربي وتبحث عن فكرة مشروع مربح في المغرب يحقق لك دخل شهري محترم فهذا المقال يعتبر الخيار الأفضل…

أكمل القراءة »

التعليم

تعرف علي كيف استخدم زيت جونسون للجسم 2024

كيف أستخدم زيت جونسون للجسم، حيث أن زيت جونسون صنع خصيصاً للأطفال…

تعرف علي هل الولد يكمل الشهر التاسع من الحمل 2024

هل الولد في شهره التاسع هناك الكثير من التساؤلات من الكثير من…

تعرف علي ما فوائد العصفر لجسم الإنسان 2024

هناك العديد من الأعشاب الطبية التي تستخدم لفوائدها الصحية والغذائية. ومن أبرز…

تعرف علي دواء ابريبيتانت Aprepitant وطريقة استعماله الاعراض الجرعات السعر – … 2024

انه معتبر أبريبيتانت أحد الأدوية المستخدمة لعلاج مضادات القيء والغثيان. هل تعرف…

تعرف علي هل نبض المبايض من علامات الحمل وعلى ماذا يدل 2024

هل نبض المبيض من علامات الحمل؟ يمكن اعتبار نبض المبيض أحد العلامات…

تعرف علي الامانتادين Amantadine دواعي الاستعمال، الآثار الجانبية، الجرعة والموانع – … 2024

الفيروسات هي كائنات طفيلية تمامًا تتكاثر عن طريق الانتشار داخل الخلية الحية…

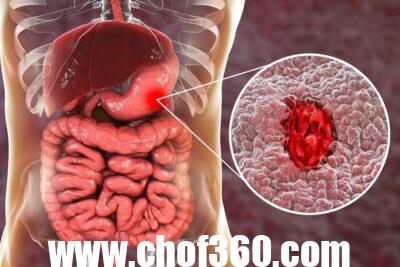

تعرف علي أسباب سرطان الكبد وعلاجه – … 2024

أسباب سرطان الكبد وطرق العلاج. يتكون جسمنا من مجموعة من الأجهزة التي…

تعرف علي هل القسط الهندي ينزل الدورة قبل موعدها وهل له أضرار – … 2024

هل القسط الهندي يسبب الحيض قبل موعده؟ تجدر الإشارة إلى أن القسط…

تعرف علي أمبين Ambien وطريقة استعماله الاعراض الجرعات السعر – … 2024

أرق بعد أرق ومثلي أرق.. والهواء يعلو والدرس ينهمر. وهو بيت من…